Money value depreciation calculator

To Calculate the Depreciation of Currency at International Level. It is fairly simple to use.

Depreciation Calculator Definition Formula

When an asset loses value by an annual percentage it is known as Declining Balance Depreciation.

. This depreciation calculator is for calculating the depreciation schedule of an asset. The formula of the depreciation and appreciation is the same rates are either below zero depreciation or above zero appreciation. If you input the value into the 3 years box the.

First one can choose the straight line method of. Straight Line Depreciation Method. For example if you have an asset.

Learn how this calculator worksThe US Inflation Calculator uses the latest US government CPI data published on August 10 2022 to adjust for inflation and calculate the cumulative inflation. Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules. It provides a couple different methods of depreciation.

Sum of digits depreciation Depreciable cost x Balance useful lifeSum of years digits Example. Percentage Declining Balance Depreciation Calculator. A good way to do so is to measure by what percentage the currency has depreciated.

Also includes a specialized real estate property calculator. The formula for calculating appreciation is as. Lets assume you were looking to buy a three-year-old car for 12000.

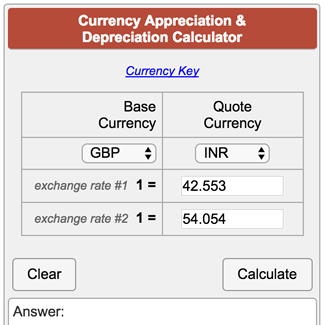

All you need to do is. The calculator also estimates the first year and the total vehicle depreciation. Steps to Calculate the Depreciation of Currency.

The basic formula for calculating your annual depreciation costs using the straight-line method is. Asset Cost Salvage Value Useful Life Depreciation Per Year. An inflation calculator shows you the value of the same sum of money at different times in the past and the future.

Select the currency from the drop-down list optional Enter the. Compare the two periods. The second method is estimating the initial value of the car.

By entering a few details such as price vehicle age and usage and time of your ownership we. When we compare two countriess currencies it will be very. It can tell you about historic prices and future inflation.

Our Car Depreciation Calculator below will allow you to see the expected resale value of over 300 models for the next decade. The four most widely used depreciation formulaes are as listed below. Depreciation asset cost salvage value useful life of asset.

Lets take a piece of. To do that divide the difference between the costs. Use this depreciation calculator to forecast the value loss for a new or used car.

The formula for this type of depreciation is. Long-term investments are depreciated for accounting. We will even custom tailor the results based upon just a few of.

Depreciation is the method of reallocating or writing down the cost of a tangible asset such as equipment over its usable life period.

Appreciation Depreciation Calculator Salecalc Com

Depreciation Formula Examples With Excel Template

Car Depreciation Calculator Calculate Depreciation Of A Car Or Other Vehicle

Annual Depreciation Of A New Car Find The Future Value Youtube

How To Calculate The Depreciation Of Currency Accounting Education

Depreciation Formula Calculate Depreciation Expense

Sum Of Years Depreciation Calculator Double Entry Bookkeeping

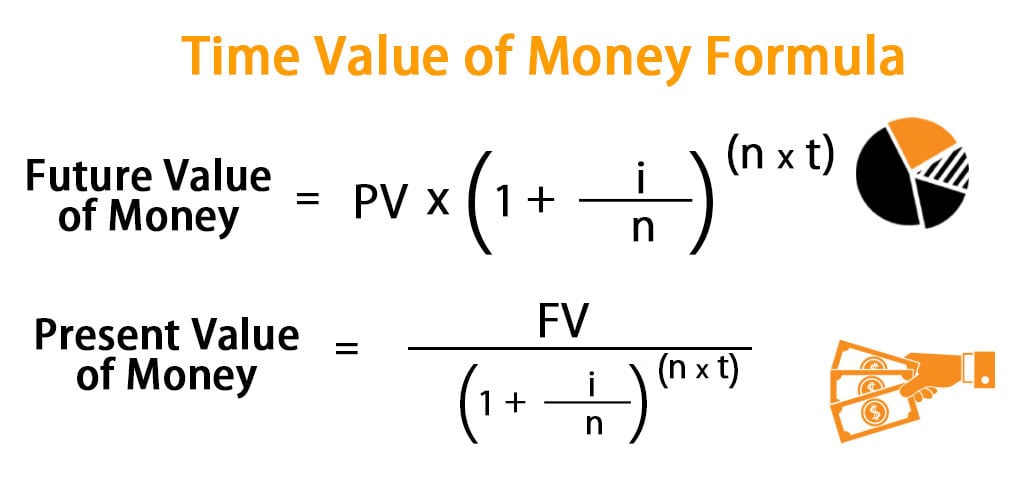

Time Value Of Money Formula Calculator Excel Template

Appliance Depreciation Calculator

1 Free Straight Line Depreciation Calculator Embroker

Depreciation Formula Examples With Excel Template

Depreciation Rate Formula Examples How To Calculate

Depreciation Calculator Depreciation Of An Asset Car Property

/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Currency Appreciation And Depreciation Calculator

/dotdash_Final_Currency_Appreciation_Definition_Apr_2020-01-063bf4cdbc9e4f4d82fa4aa46738498d.jpg)

Currency Appreciation Definition

Depreciation Formula Examples With Excel Template