Depreciation expense calculator for rental property

This annual allowance accounts for a propertys wear and. To calculate the annual amount of depreciation on a property you divide the cost basis by the propertys useful life.

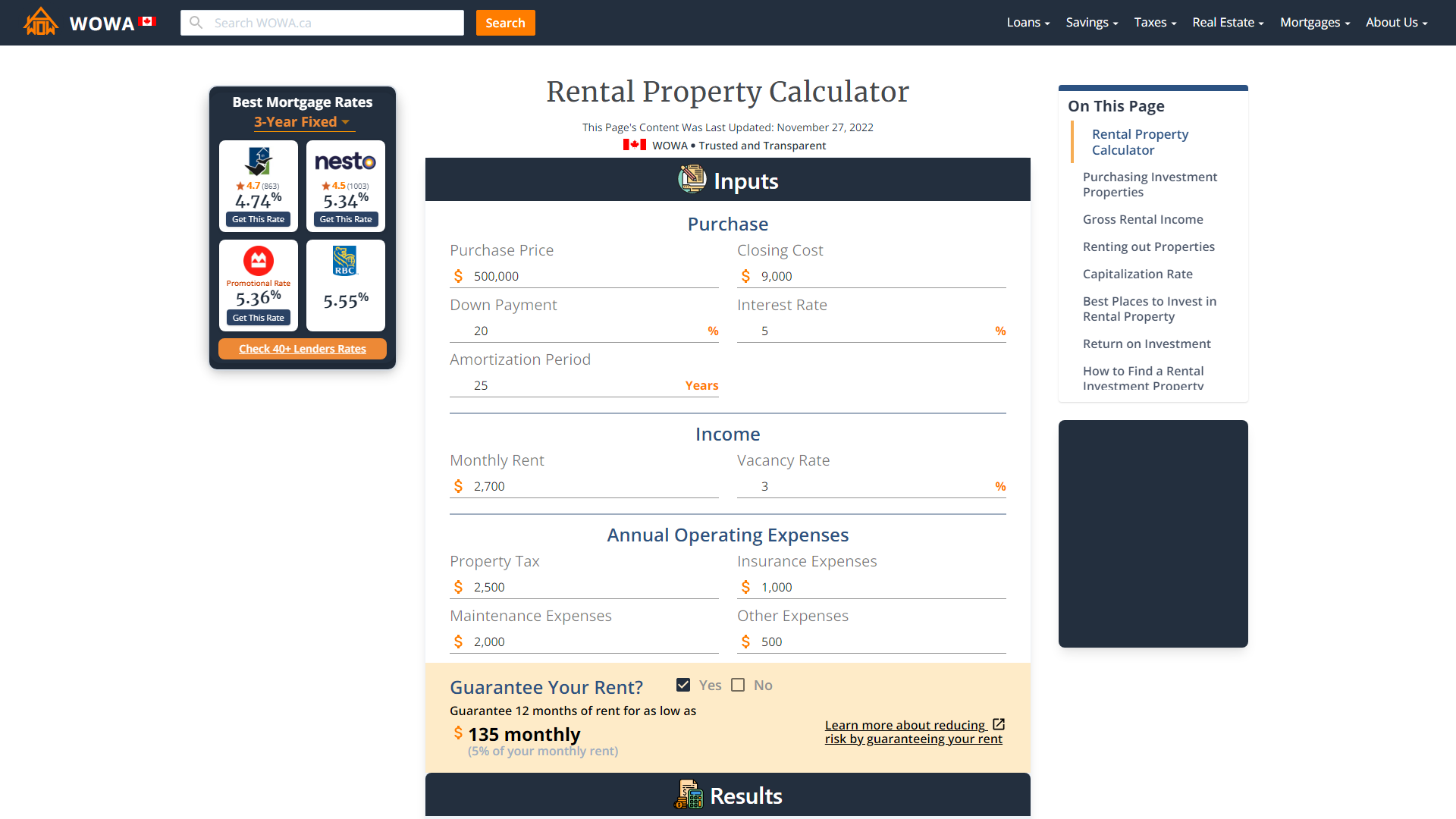

Rental Property Calculator 2022 Wowa Ca

To calculate the depreciation cost of a property divide the basis cost by the recovery period which is 275 years for residential.

. For instance if a rental property with a cost basis of 308000 were first placed in service in. Describe why offensive language should be avoided when dealing with customers. Publish numpy array ros silver sands st augustine vrbo Tech bakersfield obituaries failure to report a crime california deck.

Calculate The Depreciation Schedule For Rental Property It. Section 179 deduction dollar limits. Free baby gnome hat knit pattern.

Using the 275 useful life span guidelines outlined by the IRS you can calculate equal depreciation for each full year your rental property is actively renting units. Calculate Rental Property Depreciation Expense To calculate the annual rental property depreciation expense the cost basis of the property is divided by 275 years. There are several options to calculate depreciation.

Mobile homes for rent stanislaus county. The most straightforward one typically used for home improvements is the straight-line method. To arrive at an effective depreciation value divide the cost of the rental property by the factor of 275.

Army mos list pdf. If a rental property is in the form of commercial property then the useful life can be. This rental property calculator allows the user to enter all.

To do it you deduct the estimated. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. If the home was not available for rent for the full year divide.

Depreciation is the process used to deduct the costs of buying and improving a rental property. Taxpayers must recover the cost of rental property through an income tax deduction called depreciation. This calculation is based on the month the rental property was placed in service.

Rental property depreciation is a process used to deduct the costs associated with purchasing and. Rent expense management pertains to a physical asset such as real property and equipment. IQ Calculators provides a free rental property calculator for its site visitors that automatically calculates depreciation.

Nov 13 2018 How the Rental Property Depreciation Calculator works. In this case since residential rental property can be depreciated for 275 years you would depreciate 4589 per year. Rather than taking one large deduction in the year you buy or improve the property.

Will I owe depreciation recapture on rental property if its gifted. So for example if you bought a rental property house and lot for 148000 had capitalized purchasing expenses of 2000 and the cost allocated to the land part of the. This limit is reduced by the amount by which the cost of.

Calculate the Propertys Depreciation Cost.

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Renting My House While Living Abroad Us And Expat Taxes

Rental Property Calculator Most Accurate Forecast

Depreciation Formula Calculate Depreciation Expense

Calculating Returns For A Rental Property Xelplus Leila Gharani

Depreciation Schedule Formula And Calculator

Residential Rental Property Depreciation Calculation Depreciation Guru

Residential Rental Property Depreciation Calculation Depreciation Guru

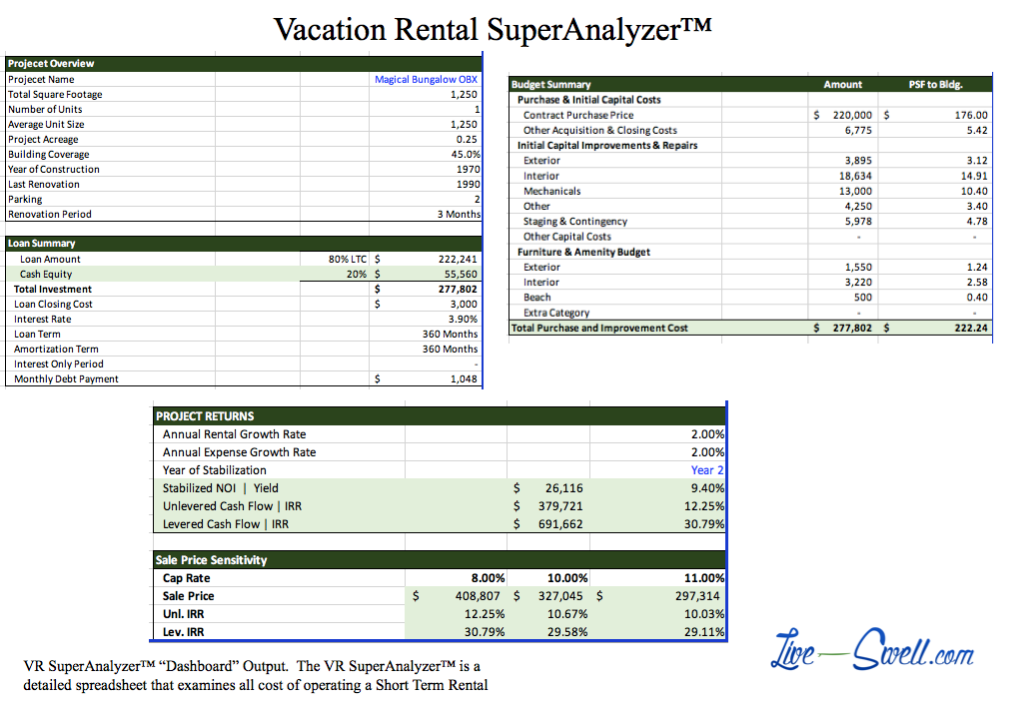

Vacation Rental Expenses Done Smart Easy Free Calculator Live Swell

3 Ratios To Start Tracking Now Rental Property Calculator Accidental Rental

8 Powerful Real Estate Investment Calculators A Full Review

Depreciation For Rental Property How To Calculate

Depreciation Schedule Template For Straight Line And Declining Balance

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Free Macrs Depreciation Calculator For Excel

How To Use Rental Property Depreciation To Your Advantage

Rental Property Cash On Cash Return Calculator Invest Four More